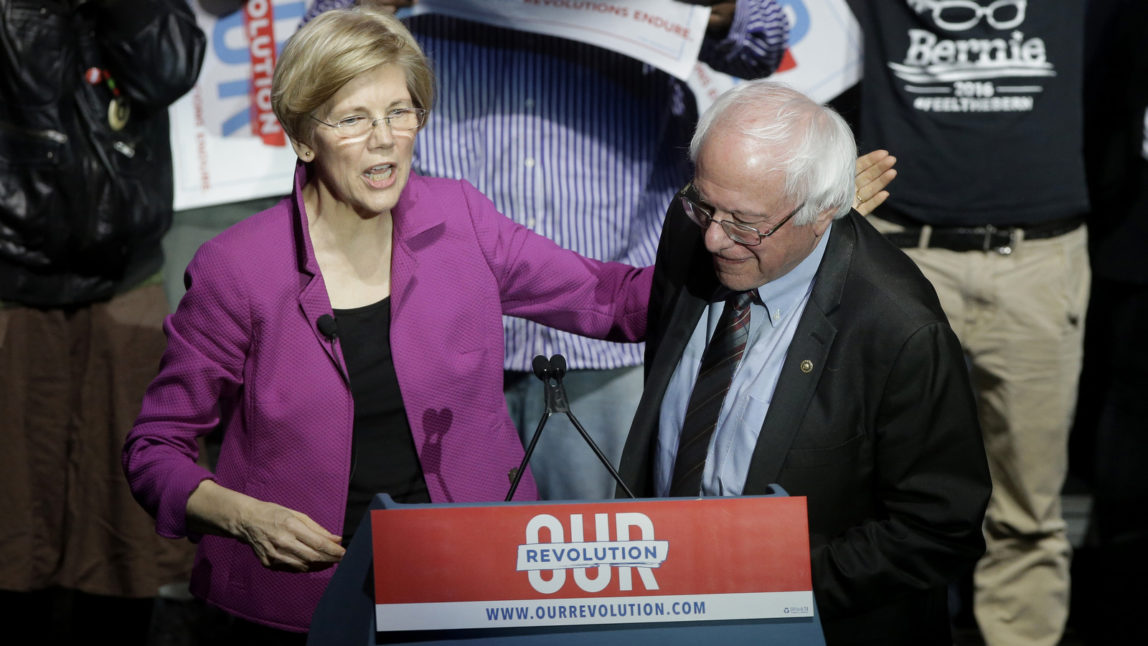

Senators Elizabeth Warren and Bernie Sanders, former presidential candidate, along with several other progressive senators introduced a bill that would seek to eliminate college tuition and fees at public four-year colleges and universities in the United States for students from families that make up to US$125,000 a year. “Our job is to bring

Sanders, Warren Propose Free Tuition Plan Funded By Tax On Wall Street

Official estimates put the student debt in the United States at more than US$1 trillion.

Por teleSUR